The Creature from Jekyll Island, A Second Look at the Federal Reserve, by G. Edward Griffin

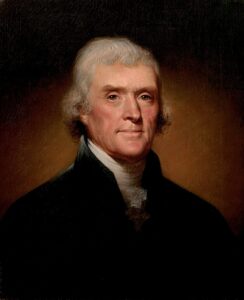

“A private central bank issuing the public currency is a greater menace to the liberties of the people than a standing army.”

“We must not let our rulers load us with perpetual debt”

-Thomas Jefferson, as quoted in The Creature From Jekyll Island

This is one of the scariest and most sickening books I have ever read. In it, Griffin examines the structure and entire history of the Federal Reserve in great detail; provides a fascinating history of the evolution of money; explores the history and inner workings of American and European banking; discusses the relationship between U.S. banking and political activities from colonial days through the present; provides detailed examples of these activities, including the American Civil War, the Boer War, the Russian Revolution of 1917; and, gives us a detailed and horrifying glimpse into the minds of the elites, who seek to control humanity in good measure through the machinations of the Fed and the World Bank.

Few Americans are even vaguely aware of how the Fed works, and far fewer are aware of its checkered history and sinister purpose. And given the fact the Fed holds our fate in its hands, The Creature is a must-read.

Few Americans are even vaguely aware of how the Fed works, and far fewer are aware of its checkered history and sinister purpose. And given the fact the Fed holds our fate in its hands, The Creature is a must-read.

One of the first revelations is to learn that the Fed, and our system of fractional reserve banking in general, is a legalized fraud that creates money out of nothing. Money of this type — fiat money — is expressly forbidden in the Constitution because the Founding Fathers had lived through the misery inevitably produced by fiat money – that is, money created by government decree with nothing to back it.

Your own checking or savings account is a fraud. When you deposit money into your checking or savings account, you are told it is a demand account – you can get your money back whenever you want it. The bank, however, only has reserves (cash on hand) of 10% or less of its deposits on hand at any given time. If there’s a run on the bank, if enough people want their money back at the same time, the bank cannot honor its commitments because the bank has loaned out 90% of everyone’s money to somebody else. The bank collects money on your deposit, as well as interest on (your money) that it has loaned out. Your money is not available on demand, as many have found out the hard way during the bank runs that have plagued society every time it has put fiat money in use.

This is essentially how the Fed operates, only in the case of the Fed, it’s worse, because the starting point is money that it creates out of nothing. The “nothing” is nothing more than a pledge from the U.S. government that it will redeem the bonds it has sold the Fed to create the cash it needs to finance the government. This is fiat money – money by decree.

Griffin describes in detail the horrific effects of this system, which we see around us all the time but fail to attribute to the Fed. Perhaps the most important effect of fiat money is inflation. Swamping the money supply with fiat money, running up enormous budget deficits, dilutes the value of every dollar we have. People complain constantly about high prices and usually blame big, bad business for its greed. However, Griffin correctly points out that prices do not go up – instead, inflation drives the value of our dollars down.

What people do not realize is that inflation is a tax. Every dollar you earn is worth less when you spend it or invest it or save it. The fruits of your labor are siphoned off by the government and the banking system in general as it creates new money by fiat or swamping the money supply by making “loans” of money they don’t really have.

Inflation is such an effective tax that the government could finance the entire government simply by creating money – no income taxes are needed! The government could simply issue new Treasury notes (debts) whenever it needed money. But the government continues to tax income, however, so as not to make the public suspicious, and also, to redistribute wealth and for social engineering. However, one of the huge appeals of fiat money to politicians is its ability to produce inflation and thus allow the government to spend money without raising taxes.

It is often said that deficit spending (and the inherent inflation) put a burden on future generations, but it is said as if it were a theoretical situation that might or might not take place decades from now. But very much to the contrary, the ravages of inflation are right in front of our faces. Younger generations struggle to buy homes, cannot make ends meet even with two incomes, and have lost hope of ever being financially independent. They are suffering from inflation. But nobody can make the connection between the pain of economic hopelessness and the cause.

If this weren’t bad enough, the inflation and other taxes we pay protect the banking system from any danger associated with reckless lending. One of the reasons the financial bigwigs rammed the Fed into existence was to use the Federal Reserve System to bail out banks. In a fair world, if a bank overextended itself and faced bankruptcy when there was a run, it would go out of business. But in our system, if a bank — a large and worthy bank, that is — gets into trouble, the Fed bails it out — which means that the taxpayer bails it out. Thus, banks have every incentive to be aggressive and make dubious loans. They make huge interest on the loan, roll it over into another loan when the debtor can’t pay, and if worse comes to worse, the Fed sends them money to keep the game going. Bailouts have been routinely used over the entire history of the Fed not only for banks, but also for railroads, airlines, automobile manufacturers, and any other business favored by the elites and financed by the banks.

As you read about the people who crafted the Fed and support it, you will quickly see the underlying purpose is to pad their pockets and consolidate their power at the expense of American citizens. This is not some evil inclination unique to American capitalists; Griffin shows this has been the way of the world since the beginning of money – he observes, in fact, that the structure of the Fed is a near exact replica of that used by Imperial Rome. But the fact that greed and coldheartedness reigns supreme is not the worst of it. Griffin describes in detail why American political and financial elites are in the main globalists. They are not primarily loyal to the U.S., but instead, use the Fed as a major artery whose destination is a global government with one set of rulers and one central bank. Global government and a single global currency cannot come into existence with an economically dominant United States. Thus, inflation, foreign loans, foreign grants, and even boondoggle domestic governmental programs are designed to squander American power and economic independence and make our country more like less economically vibrant and socially stable countries. It is not stupidity, it is by design.

There is much more to the story, and it is a story every American must know. We are very far along a road from which any return route will be painful — but not nearly as painful as what awaits us at the end of the Fed Highway.